Sales Tax Act 2018 to enable them to enjoy the facilities given under the Act. You can also check if a product is subject to control by any competent authority.

How Does Electricity Tariff Detail Breakdown In Malaysia Are Calculated Quora

Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods.

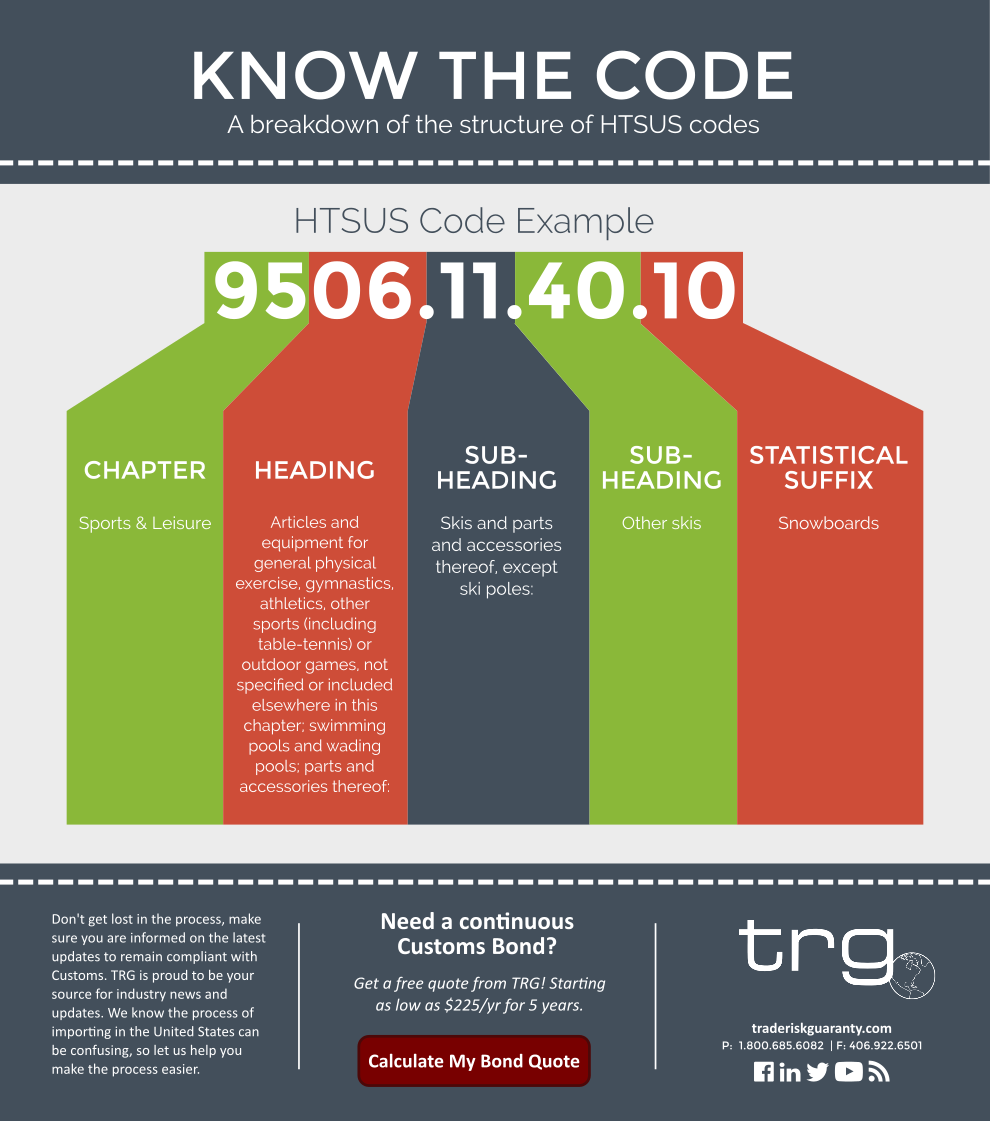

. The original Customs Compendium series was published in 2006. Know your products HS Code. Wednesday October 3 2018.

Clicking on a link will load the corresponding Adobe pdf file. Second Edition Sept 2016. AHTN is used for trade transaction between Malaysia and the other ASEAN countries while the HS Code applies for trade with non-ASEAN countries.

Goods exported from Malaysia transported to FIZ or Labuan or moved to LMW for repair and subsequently re-imported or returned by the same route is subject to. IMPORT DUTY STAGING CATEGORY. 010512000 - - Turkeys.

Trying to get tariff data. Malaysias total trade soars 213 to RM23144bil in April The Star Online. HS CLASSIFICATION HANDBOOK WORLD CUSTOMS ORGANIZATION Rue du Marché 30 B-1210 Brussels Telephone 32-2-2099211 Fax 32-2-2099492 November 2013.

03-5523 2827 E-mail. Revised July 2018 Page 231 41 DEFINITION 411 HEALTH SUPPLEMENT HS A Health Supplement HS means any product that is used to supplement a diet and to maintain enhance and improve the health function of human body. Malaysia adopts a self-assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer.

Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory to apply the 6-digits HS Code to be declared in the Export Import and Transhipment manifest in Malaysia. All income of persons other than a company limited liability partnership co-operative or trust body are assessed on a calendar year basis. 27 000 - - Cuts and offal frozen 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 -.

HS Code Description Base Rate 2005 MFN 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years 01 Live animals 0101 Live horses asses. Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the Cust. TRQ as specified in Appendix B TRQ.

MALAYSIA - Mandatory HS 6-digits commodity code Dear Valued Customers Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory to apply the 6-digits HS Code to be declared in the Export Import and Transhipment manifest in Malaysia. TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. Last published date.

The HSCA Product Code Search Engine is available for you to do a quick search for the HS codes product codes and descriptions of a product within the Singapore Trade Classification Customs Excise Duties. For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent considerably higher effective tariff rates. Malaysias trade in April increases to RM23144b theSundaily.

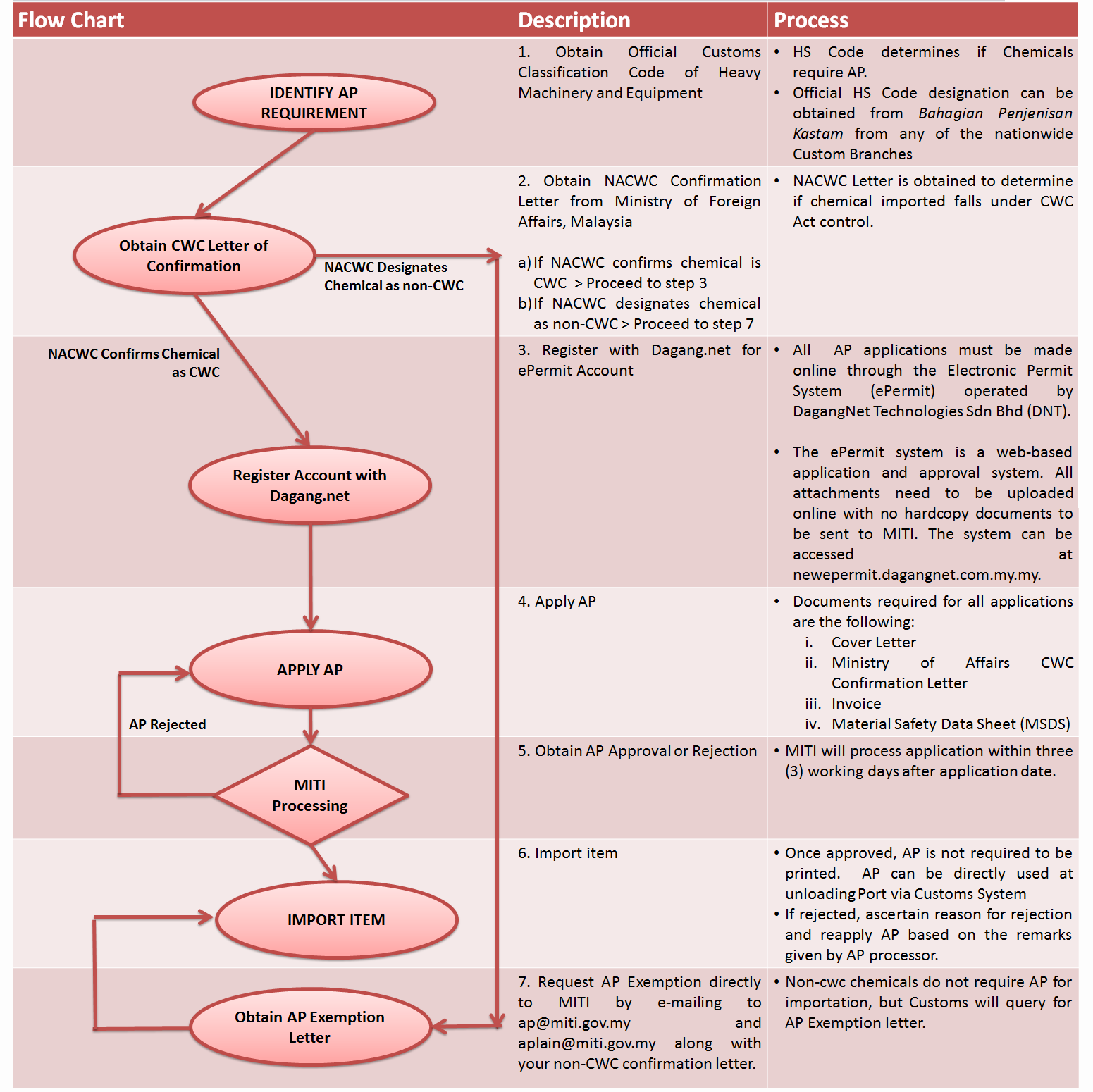

If a product is controlled the Import Export. MALAYSIAS TARIFF SCHEDULE UNDER THE MALAYSIA-INDIA COMPREHENSIVE ECONOMIC COOPERATION AGREEMENT MICECA HS CODE Chapter 1 - Live animals Page 39. Jalan Pahat H15H Dataran Otomobil Seksyen 15 40200 Shah Alam Selangor Malaysia.

On this occasion of the Harmonized Systems 30th Anniversary the Harmonized System Compendium 30 Years On has been published an updated and expanded version of the existing Customs Compendium to meet the needs of a new generation of Customs. Malaysias red-hot trade in April puts economy on solid growth path New Straits Times. Description 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years 01 Live animals 0101 Live horses asses mules and hinnies.

National Pharmaceutical Regulatory Division Ministry of Health Malaysia. June 2018 is the FY ending 30 June 2018. DECLARATION OF HS CODE IN COST ANALYSIS AND CERTIFICATE OF ORIGIN COO Starting 1st April 2017 Perintah Duti Kastam PDK 2017 has been implemented to replace the PDK 2012.

Therefore exporters are required to consult the Royal Malaysia Customs Department RMCD to obtain the accurate tariff code for their respective finished products and raw. This is in conjunction with the implementation of the new Customs operating. Malaysias total trade soars 213 to RM23144 bil in April 2022 MITI The Edge Markets MY.

The difference between HS Code and AHTN code. It is presented in small. 21 000 - - Pure.

The links below correspond to the various sections in the Table of Contents for the Harmonized Tariff Schedule. This page contains the chapter-by-chapter listing of the Harmonized Tariff Schedule and general notes. 03- 5523 1819 Fax.

Manufacturers who carry out its business as a subcontractor and the total labour. Genoa 03rd October 2018 Subject. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

China Hs Code Lookup China Customs Import Duty Tax Tariff Rate China Gb Standards Ciq Inspection Quarantine Search Service

5 Things To Know About The Harmonized Tariff Schedule Hts Code

How To Find Hs Code For Export Or Import Products Verified And Tested Pakistancustoms Net

Pdf Water Tariff And Development The Case Of Malaysia Semantic Scholar

Kementerian Perdagangan Antarabangsa Dan Industri

Malaysia Logistics Buzz Haulage Tariff Effective 01st May 2020

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysian Customs Classification Of Goods Get The Right Tariff Codes